Wills & Estate Planning

Sydney wills & estate planning law expertise in the palm of your hand

Protect your life’s work and take care of your loved ones

You’ve worked hard all your life, and now you want to make sure everything you’ve achieved is protected. There’s nothing wrong with that!

Whether you’re looking to secure an inheritance for your children, dictate succession in your business, or donate to a charity, InFocus Legal can create an airtight will or estate plan.

Who we help

- Anyone - Everyone should have a will, not just the elderly or the wealthy

- Business owners - Plan for your absence with a clear and actionable succession plan

- Charitable donations - We’ll help you make sure your assets go those who need it most

InFocus Legal can assist you with all the most common aspects of wills & estates law.

We’ll make sure your interests are protected and give you the confidence to make informed decisions.

Sydney wills & estate law expertise

Our knowledge of Sydney family law regulations will ensure your matter is resolved as quickly and delicately as possible

Save time

Our app will easily let you upload documents, review the progress of your matter, and receive regular updates from our team

Peace of mind

We understand the comfort that knowing your affairs are handled brings, so secure your legacy and know your loved ones will be looked after

Quick and clear, no obligation quote

know our costs upfront so there are no surprises.

Convenient

we can meet you in person or online

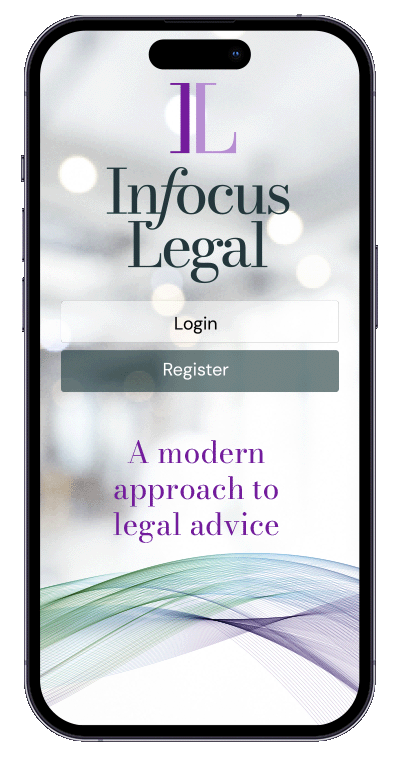

Our App

To make your transaction simpler and faster, we’ll provide you with an online dashboard. This dashboard will help you:

- Track the progress of your matter

- Upload required documents and sign documents electronically

- Easily see what actions require your input, and which ones require ours

- Receive regular updates on your matters which you can access from anywhere

FAQ

A will is a legal document which sets out who will receive your property when you die. As well as giving away property in your will you can appoint the person you want to be your executor to make sure the will is followed, and if you have young children you can also appoint someone to be their guardian.

When you have a valid will, you give yourself the best chance of making sure your assets go where you want them to. If you are over eighteen (18) years old you should make a will. This is particularly important if other people are financially dependent on you.

A will generally needs three things to be valid:

- It must be in writing (whether handwritten, typed or printed)

- It must be signed and should be dated, and

- Your signature must be witnessed by two other people who also need to sign the will.

Even when the will seems to be valid, sometimes it can be challenged. It might be challenged, for example, if you did not know or understand what you were signing, or if you were forced to sign against your will.

If you die without a valid will (known legally as ‘dying intestate’) a standard formula is used to distribute your property and possessions. Usually, this means all your assets will pass to your spouse or children.

But the situation becomes much more complex if you have a legal spouse and a de facto spouse (i.e. you’ve separated and have a new unmarried partner), if you have children from different relationships, or if you die with no spouse and no children.

The standard formula only takes into account certain family members. So having a valid will is vital if you do not have close family members or want to leave gifts to friends or charities

When you make a will you’ll need to appoint an executor, who will handle your affairs when you die. You can name more than one executor, but it is important to choose people who will be willing and able to work with each other.

An executor’s role is to obtain probate, pay your debts, and distribute your assets in line with your will.

Before you nominate someone as executor or trustee, you should make sure they’re comfortable taking on the responsibility you’re giving them. It’s often a good idea to appoint someone younger than you, or to nominate an alternative executor, in case the one you have appointed dies before you do. It is also important to choose someone you trust, who will take responsibility for ensuring that your estate is properly administered.

Because of their expertise in administering wills, people often choose to appoint their solicitor as executor.

You are free to change your will whenever you like. And you should always change your will when your circumstances change – for instance, if you divorce or remarry, or if one of your beneficiaries dies.

But you can’t just change your will by crossing something out and writing something different.

As with a will, changes to a will need to be in writing and signed and witnessed by two people.

Where you want to make a major change to your current will, it is usually better to make a whole new will.

Generally, getting married cancels the terms of any will you have previously made. There are some exceptions, which your solicitor can explain to you.

If you divorce, it cancels any gift you made to your former spouse under your will. Again there are some exceptions, which your solicitor can explain to you.

You should always make a new will if you marry, divorce, if you have separated from your spouse, or if you have started a de facto relationship.

You can leave your assets to whoever you like, but you have a general obligation to provide adequately for your spouse or de facto partner, your children, and any other dependents. If you don’t they can bring a claim against your estate.

You should always keep your will in a safe place and let your executor know where to find it. That’s because, if you misplace your will and no one can find it, this will create problems and may prevent your will from being effective. We can store your will for you (at no charge) and give you a copy for your own records.

Some people choose to make their own will. We think that’s a mistake. Although writing your own may seem easy enough, the law around wills can be complex.

When you make a homemade will, you risk not drawing it up properly or not expressing your intentions clearly enough. Many homemade wills lead to delay and additional legal costs after the person has died.

In the worst cases the wishes of the person who made the will are not followed because of some problem with the will. That’s why, when you make your will, it’s important you have it drafted by someone who understands the law and can advise you on the best way to make sure your assets end up where you want them to. And that means engaging a solicitor.

It’s a good idea to involve a solicitor whenever you want to make changes to your will or draw up a new one. Your solicitor can:

- Make sure your will is valid and that it is properly drawn up, signed and witnessed

- Make sure you’ve expressed your wishes in the best possible way, so nothing is left to chance

- Advise you on your rights and obligations to your spouse or de facto partner, children and other dependants.

- Advise you on tax planning, including the best way to minimise any potential capital gains tax from the gifts you’re making

- Give you a thorough understanding of the role of your executor and trustee and help you choose appropriate ones

- Advise you on what happens to your superannuation after you die

- Advise you on making a power of attorney and appointing an enduring guardian

- Store your will in a safe place so your executor knows where it is.

Some of our biggest fans